Cyprus IP Box Regime: How to Get 2.5% Tax Rate in 2025

Our blogs are regularly updated to ensure information is current and accurate.

Andreas is a Corporate Lawyer and Managing Director of EasyCorporate. Read more

The Cyprus IP Box Regime is a tax benefit system that significantly reduces taxes on income from intellectual property. In this guide, we’ll explain how it works, who can benefit, how to apply, and what you need to know to determine if your business is eligible for this tax advantage.

What is the Cyprus IP Box Regime?

The Cyprus IP Box Regime lets businesses pay much less tax on income from certain types of intellectual property. Instead of the usual 12.5% corporate tax rate , companies can pay as low as 2.5% on qualifying IP income, thanks to an 80% exemption on eligible profits.

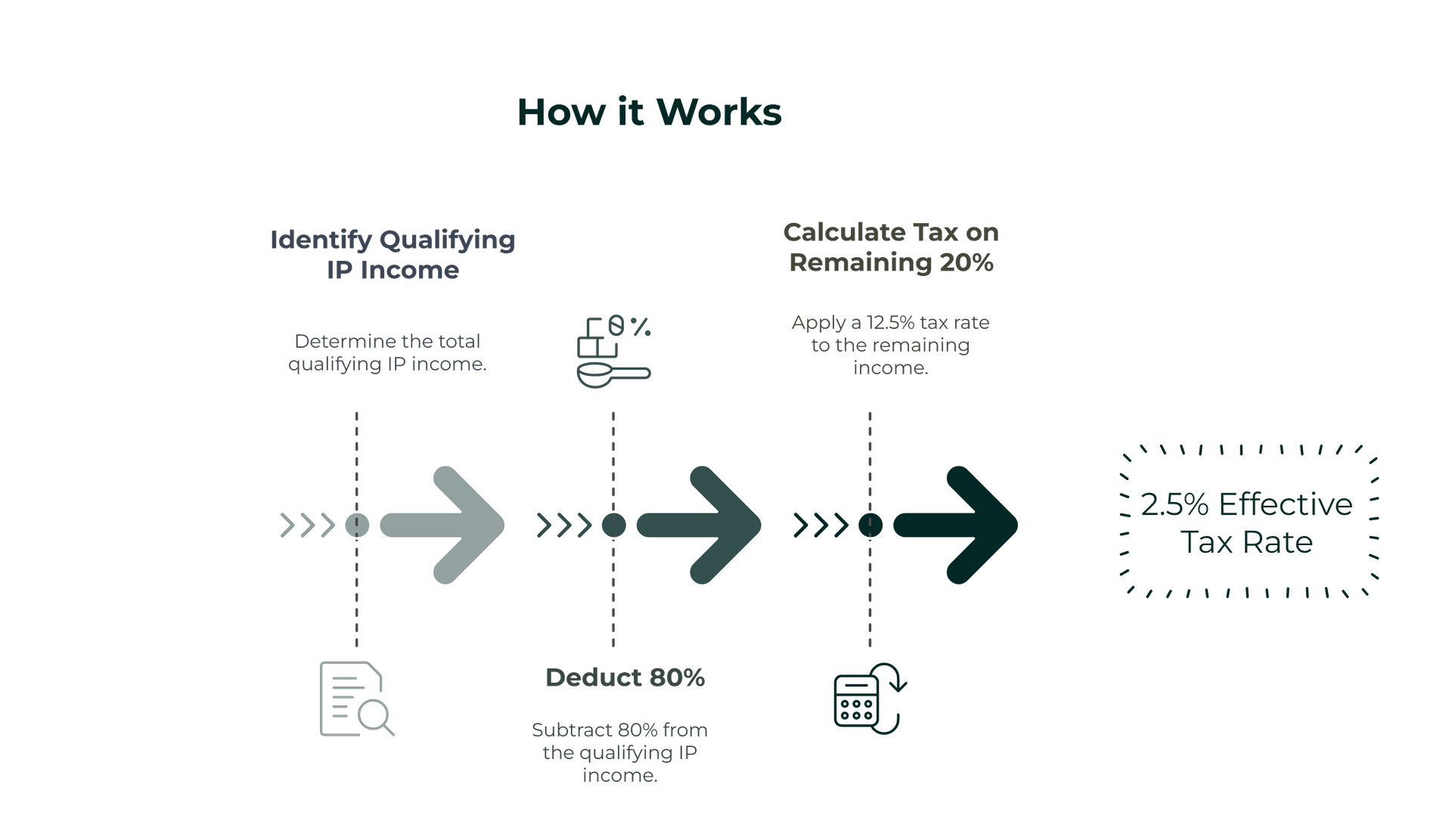

How the Tax Rate Actually Works

Many people think the Cyprus IP Box Regime is a flat 2.5% tax on profits from developing IP, but it’s not that simple. The 2.5% tax rate comes from the fact that you get to ignore 80% of your qualifying IP income for tax purposes. You only pay tax on the remaining 20%, and at a rate of 12.5%. This means, in the end, the effective tax rate on that qualifying income works out to just 2.5%.

Not Just for Tech Companies

You might have heard about the IP Box before, especially if you're in the tech industry since it's getting a lot of attention in the last few years. But it’s not just for tech companies. Businesses across various sectors can benefit from it.

Why Cyprus Created This System

Similar to the Startup Visa Scheme and Non-Dom status tax benefits, Cyprus set up the IP Box Regime to turn the country into a hub for innovation by making it cheaper for businesses in Cyprus to invest in research and development.

Making It Simple

If you’ve read any articles online about it before, you might understand the basic idea. But the details can be tricky to fully grasp because they’re not always explained in simple terms. That is exactly why we, at EasyCorporate have created this guide. We saw the need for a straightforward, easy-to-follow explanation of how this tax framework works.

Before you start sending money to your lawyer/accountant to start applying for it, it’s important to see if your business qualifies for this tax exemption.

The purpose of this guide is to help you figure out whether or not you're eligible and understand the potential advantages of the IP Box Regime. We want to give you clear, practical information so you can make an informed decision before committing time and money to pursue this tax status.

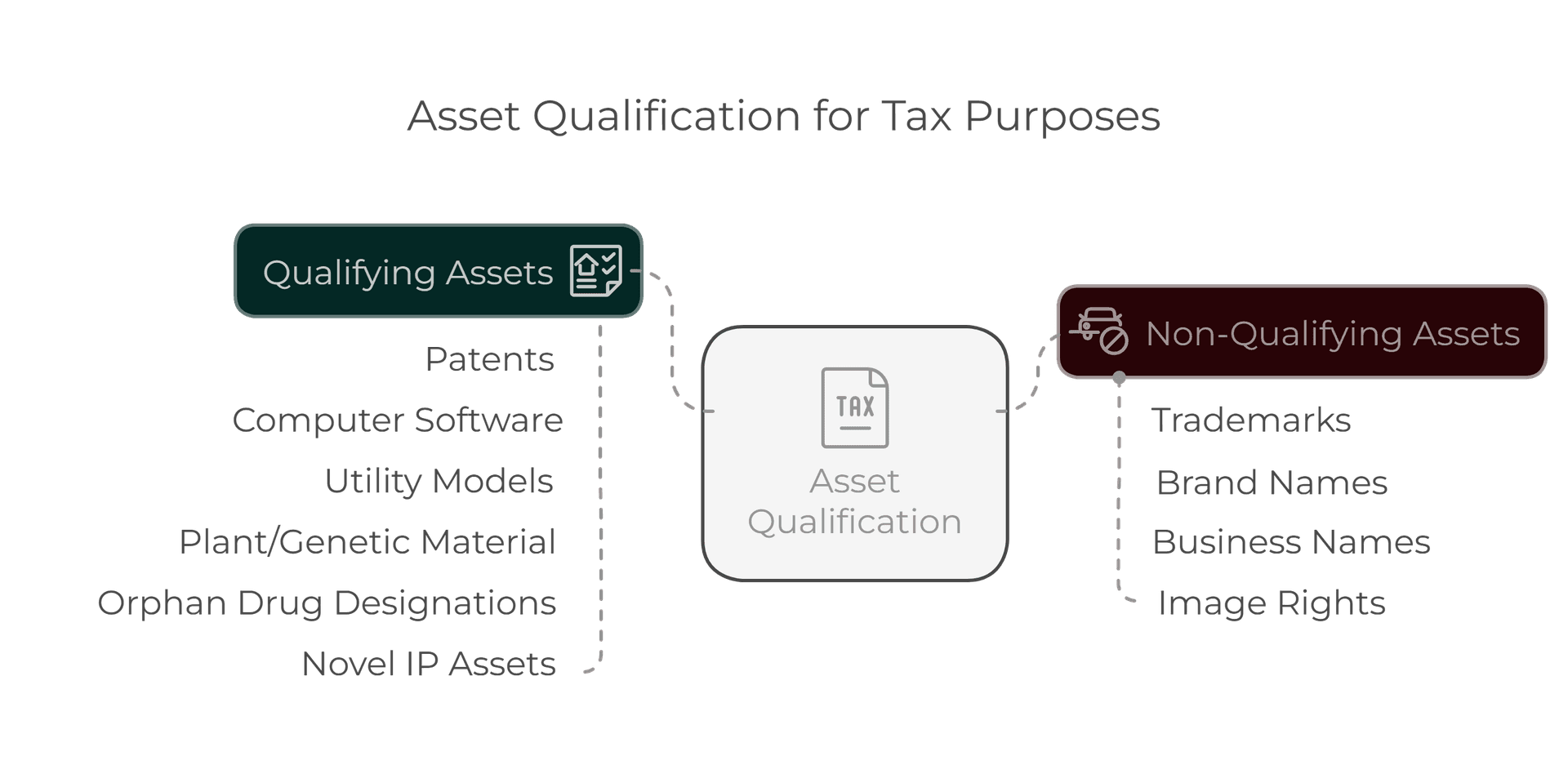

Qualifying IP Assets

Let’s get down to what intellectual property can qualify for this tax regime.

Patents

These are new inventions that have been officially approved and protected by a patent office. These can either be products, methods, processes, materials etc. that are registered.

In Cyprus, such inventions are registered with the Department of the Registrar of Companies and Intellectual Property. Your invention has to be genuinely new, not just a minor tweak to something that already exists.

For example:

Imagine you’ve invented a new way to manufacture products that cuts production time in half.

Computer Software

This covers original software programs you’ve developed from scratch. We’re not talking about basic websites or simple apps here, we mean substantial software developments.

The key is that it has to be original and involve significant development work.

For example:

If you’ve developed an AI model that helps businesses manage their entire operation (like inventory, sales and employee scheduling all in one), that would qualify.

Utility Models

Think of these as “mini-patents” for smaller improvements to existing products.

It might not be a completely new invention, but it’s a significant improvement to something that already exists.

For example:

Let’s say you’ve found a way to make smartphone batteries last 30% longer by tweaking their design - that’s a utility model.

Protected Plant/Genetic Material

This one is a bit more specific which mostly concerns people in the biotech industry.

This isn’t about traditional farming - it’s about using science and technology to create new plant varieties or genetic innovations.

For example:

If you’ve developed a new type of crop that can grow with less water, or created a new method for improving plant resistance to disease, you’re in this category.

Orphan Drug Designations

This applies to companies developing treatments for rare diseases. These projects are especially valuable because they often lack commercial incentive without special support.

For example:

If you’re working on a medicine for a condition that affects a small number of people, your R&D work could qualify

Novel IP Assets

This one’s for smaller companies (with revenue under €7.5M, or €50M for groups). Your innovation has to be new, useful and not obvious to experts in your field.

For example:

If you’ve developed a new way to make batteries more efficient through a unique chemical process, this would qualify.

Non-Qualifying Assets

Understanding what doesn't qualify is equally important:

Trademarks

These are your company’s distinctive signs or symbols - like McDonald’s golden arches or Nike’s swoosh. While they’re valuable for your brand, they don’t count as technical innovations. Think of them as your company’s signature rather than an invention.

Brand Names

The actual names you give your products or services (like “iPhone” or “Coca-Cola”) don’t qualify. These are marketing tools, not technical innovations. No matter how clever your brand name is, it won’t be eligible for the IP Box benefits.

Business Names

Your company’s name (like “Microsoft” or “Amazon”) isn’t eligible. Even if you have the most creative company name in the world, it’s still just an identifier, not an innovation.

Image Rights

If you have the rights to use a celebrity’s photo in your advertising or to put someone’s face on your products, that’s not covered. These are marketing assets not technical innovations so don’t qualify for the tax benefits.

Will your IP qualify?

The key thing to remember is the IP Box Regime is designed to reward genuine technical innovation and development work.

If your intellectual property involves creating something new or significantly improving something that already exists, you’re on the right track. If it’s more about marketing, branding or identification, it probably won’t qualify.

How the Tax Benefit Works in Practice

Basic Tax Calculation Example

Suppose your company earns €1,000,000 qualifying profit from qualifying IP assets:

Standard taxation: €1,000,000 × 12.5% = €125,000 tax

IP Box Regime taxation:

- Calculate exempt portion: €1,000,000 × 80% = €800,000

- Taxable portion: €1,000,000 - €800,000 = €200,000

- Tax due: €200,000 × 12.5% = €25,000

Effective tax rate: €25,000/€1,000,000 = 2.5%

Tax savings: €100,000

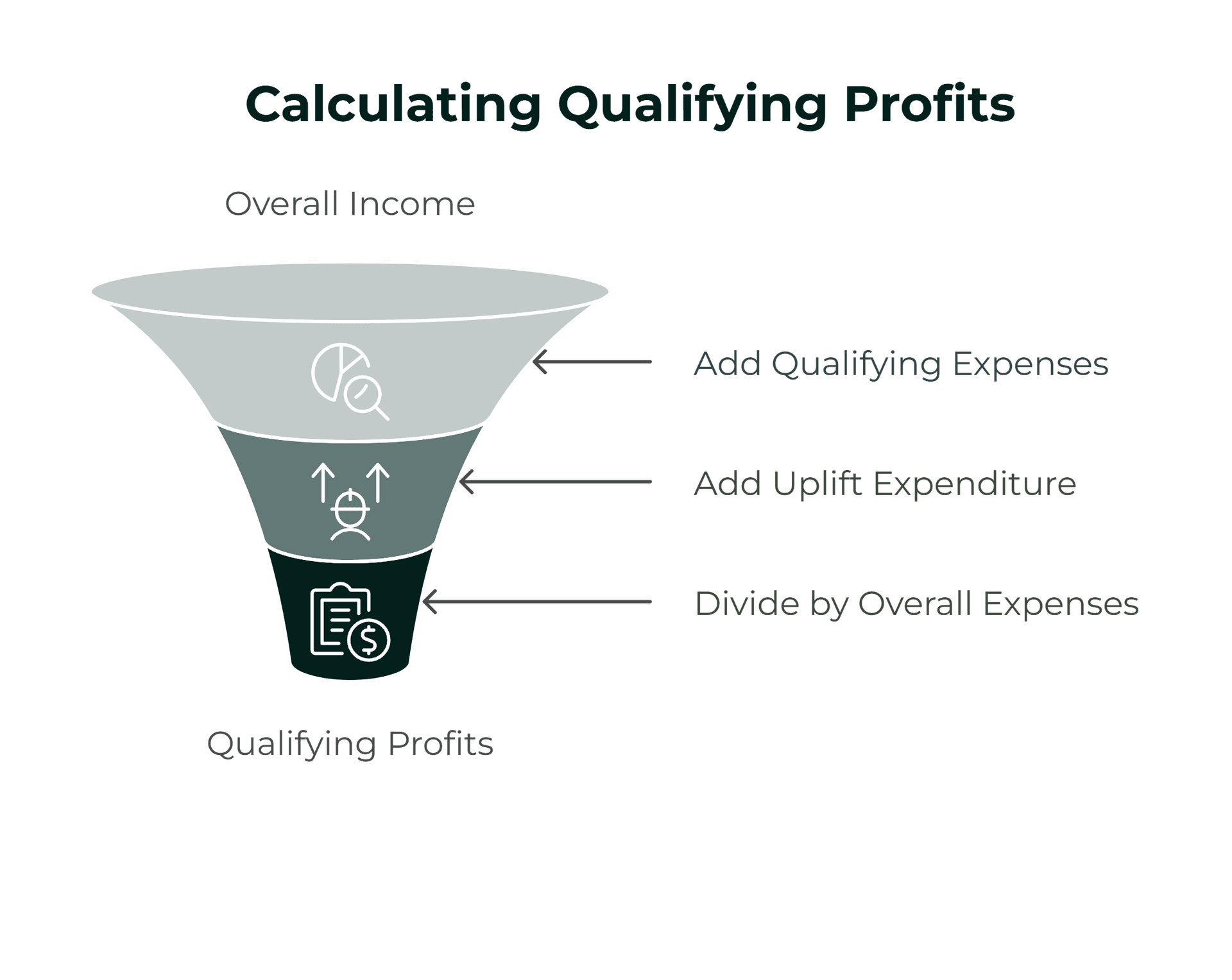

Qualifying Profit Calculation

So from the example above you can see that the thing we are after is to figure out how much is the Qualifying Profit. We do that by using a formula to calculate how much of your IP income qualifies for the 2.5% tax rate:

The Formula:

QP = OI × (QE + UE)/OE

QP (Qualifying Profits)

This is the final amount that will qualify for the 2.5% tax rate.

OI (Overall Income)

This is all the money you make from your qualifying IP assets minus the direct costs of making that money. In other words, this is your gross profit. It includes:

- Money from royalties

- License fees

- Insurance payouts related to these assets

- Money from selling these assets (except capital gains)

- Income embedded in products/services using these assets

The direct costs you can subtract include:

- Any costs directly related to earning income from these assets

- Asset depreciation costs

- A special Cyprus tax deduction for notional interest

QE (Qualifying Expenditure)

This is the money you spend developing your IP in Cyprus, including:

- Employee salaries and wages

- Direct operational costs

- Facility expenses used for R&D

- Commission costs for R&D

- R&D work outsourced to unrelated companies (independent third paries)

Important exclusions:

- Buying intangible assets

- Interest payments

- Property purchases

- R&D done by related companies (i.e. subsidiaries or parent companies)

- Costs that can't be directly linked to specific assets

UE (Uplift Expenditure)

This is a bonus amount the government lets you add to your qualifying expenditure. It's the lower of:

- 30% of your qualifying expenditure (QE), or

- The total of IP acquisition costs and related-party R&D costs

OE (Overall Expenditure)

This is everything you've spent on the IP, including:

- All your qualifying expenditure (QE)

- Any costs of buying IP rights

- R&D work done by related companies

Step-by-Step Example

Let's walk through this using an example. Imagine your company has developed an innovative software system. We'll calculate exactly how much of your income qualifies for the special 2.5% tax rate.

Step 1: Calculate Their Overall Income (OI)

First, let's add up all money earned from your IP:

Money coming in:

- License fees (other companies paying to use your software): €500,000

- Royalties: €300,000

- Money from selling products using your IP: €400,000

- Insurance compensation for IP: €50,000

- Total: €1,250,000

Then subtract all direct costs:

Money going out:

- Development team salaries: €200,000

- Equipment depreciation: €50,000

- Direct software costs: €100,000

- Total: €350,000

Your Overall Income (OI) = €1,250,000 - €350,000 = €900,000

Step 2: Calculate Your Qualifying Expenditure (QE)

This is money spent directly on developing your IP:

Research and development costs:

- R&D staff salaries: €300,000

- Testing equipment: €75,000

- Lab supplies: €25,000

- R&D outsourced to unrelated companies: €100,000

Total Qualifying Expenditure (QE) = €500,000

Remember: Things like office rent, marketing costs, or work done by related companies don't count here.

Step 3: Calculate Your Uplift Expenditure (UE)

This is a bonus amount. You take the lower of:

30% of your Qualifying Expenditure (€500,000 × 30% = €150,000) OR

Money spent on:

- Buying IP rights: €80,000

- R&D done by related companies: €40,000

Total: €120,000

In this case, we use €120,000 as it's the lower amount.

Step 4: Calculate Your Overall Expenditure (OE)

Add together:

- Your Qualifying Expenditure: €500,000

- Cost of buying IP: €80,000

- R&D done by related companies: €40,000

- Total Overall Expenditure (OE): €620,000

Step 5: The Final Calculation

Let's plug our numbers into the formula:

- Overall Income (OI) = €900,000

- Qualifying Expenditure (QE) = €500,000

- Uplift Expenditure (UE) = €120,000

- Overall Expenditure (OE) = €620,000

The formula is: Qualifying Profit = Overall Income × (Qualifying Expenditure + Uplift Expenditure) ÷ Overall Expenditure

Let's do this step by step:

- First, add QE + UE: €500,000 + €120,000 = €620,000

- Divide this by Overall Expenditure: €620,000 ÷ €620,000 = 1 (or 100%)

- Multiply this by Overall Income: €900,000 × 1 = €900,000

This means €900,000 qualifies for the special tax rate.

The Tax Bill

Now let's calculate how much tax your company will actually pay:

- Income qualifying for 2.5% tax rate: €900,000

- Tax at 2.5% = €900,000 × 2.5% = €22,500

If this same income was taxed at the normal 12.5% rate, your company would pay:

- €900,000 × 12.5% = €112,500

Tax savings: €112,500 - €22,500 = €90,000

In this example, by qualifying for the IP Box regime, your company would save €90,000 in taxes!

Who Can Apply?

| Tax Residents of Cyprus | People or businesses that live or operate in Cyprus and pay taxes here. |

| Permanent Establishments (PEs) of Non-Tax Residents | Branches or offices in Cyprus owned by non-residents that are considered tax residents. |

| Overseas PEs Liable to Pay Tax in Cyprus | Foreign businesses that are subject to pay taxes in Cyprus. |

In other words, if you or your business is based in Cyprus or you pay taxes here, you are considered eligible.

How to apply for the IP Box

To check if you’re eligible for the reduced tax rate, you should make an official request to the tax department.

This is done through a Tax Ruling which is basically getting official confirmation about how your IP income will be taxed.

What's a Tax Ruling?

Think of a tax ruling as getting an official "yes" from the tax department about your situation. It's the same process that many crypto traders use to make sure how their crypto will be taxed.

How to Apply

You'll need to provide:

- Information about your intellectual property

- Details about your R&D work

- How you've worked out your qualifying income and costs

- Evidence showing you meet all the requirements

What It Costs and How Long It Takes

Tax Department fees:

- Regular way: Pay €1,000 and wait 3-5 months

- Fast track: Pay €2,000 and get an answer within 21 working days

What to expect after getting a Ruling?

Once you get an answer from the tax department:

- You'll know exactly what income qualifies for the 2.5% tax rate

- You can structure your R&D spending the right way from the start

- You avoid any surprises or disputes with tax authorities later

- You can plan your IP development better

Most businesses get professional help to prepare their application. Yes, it costs extra, but it helps make sure everything's done right the first time.

How to Get the Most Out of the Cyprus IP Box Regime

Want to get that 2.5% tax rate everyone talks about? It’s all about how you spend your R&D money. The more of your spending that falls under “qualifying expenses” the more of your income will be taxed at the lowest rate.

What You Should Do

-

Keep R&D in-house: Do your R&D within your Cyprus company. When you spend money on your own R&D team and equipment it all counts as qualifying expenses. More of your income will be eligible for that 2.5% rate.

-

Choose outside help carefully: Sometimes you need to outsource some R&D. That's fine, but make sure you’re working with independent companies. Money spent on R&D with unrelated companies still counts as qualifying expenses.

What You Should Avoid

-

Related company work: If you get R&D done by companies connected to yours (like parent companies or subsidiaries), that spending won't count as a qualified expense. This means less of your income will qualify for the low tax rate.

-

Be careful with non-R&D costs: Buying existing IP, marketing or general office costs don’t count as qualifying expenses. The more you spend on these the less tax benefit you’ll get.

The bottom line? Focus your spending on qualifying R&D expenses, either in-house or with independent companies. This way, more of your IP income gets that 2.5% tax rate instead of the standard 12.5%. It's that straightforward.

How EasyCorporate can help

The reason we have written this guide is to help you figure out if you’re eligible for the Cyprus IP Box Regime before you spend money or time on applications. If you’re not sure whether you qualify or need help with the process, EasyCorporate can help.

We’ll walk you through everything, from checking your eligibility to handling the paperwork and submitting your application. Our goal is to make it as simple as possible so you can focus on your business while we handle the details.

If you want any help figuring this out or need assistance with applying, make sure to Send us a Message .

Our blogs are regularly updated to ensure information is current and accurate.

FAQ: Common Questions About This Topic

Can I combine the IP Box regime with other Cyprus tax benefits?

Yes, you can combine the IP Box regime with other tax benefits like the Non-Dom status.

What happens if I acquire IP rights from another company?

The costs of acquiring IP rights don't count as qualifying expenditure, but they are included in your overall expenditure calculation. This means purchased IP can still generate tax benefits, but the effective tax rate might be higher than 2.5% since acquisition costs affect the qualifying profit formula.

Do I need to register my IP in Cyprus to qualify?

No, you don't necessarily need to register your IP in Cyprus. The IP can be registered in any jurisdiction. However, the development activity and substantial economic activity related to the IP should take place in Cyprus to qualify for the tax benefits.

What if my R&D activities are partially conducted outside Cyprus?

While you can outsource some R&D work outside of Cyrus, your tax benefits will be reduced. There must be a direct link between the qualifying income and the R&D activities. In other words, to take full advantage of the IP Box regime, your R&D work should be done through your company in Cyprus.

How often do I need to recalculate my qualifying profits?

You need to calculate qualifying profits annually when filing your tax return. However, it's recommended to track qualifying expenses and income monthly or quarterly to ensure proper documentation and make informed business decisions throughout the year.

Can startups benefit from the IP Box regime?

Yes, startups can benefit if they're developing qualifying IP. However, they need to carefully document their R&D activities from the beginning and may need to wait until they generate income from their IP to realize the tax benefits. The regime is particularly attractive for tech startups developing software or novel technical solutions.

What happens if I sell my IP-generating business?

If the sale of you IP-generating business is considered a capital nature transaction, then any money you make from the sale will be tax free. Qualifying profits earned up to the sale date would still qualify for the reduced tax rate. The buyer may also be eligible for IP Box benefits if they continue development activities in Cyprus.

How do I prove my software development qualifies as substantial?

Simply tweaking open-source code or making minor changes to existing software won't qualify. You need to show you're creating something genuinely new. This means detailed documentation of your development process, technical specifications, and proof that you're building innovative features from the ground up. Make sure to keep records of your R&D work.

What records do I need to keep for IP Box compliance?

Maintain detailed records of: All R&D activities and associated costs, Documentation proving the innovative nature of your IP, Contracts with external R&D providers, Income directly attributable to the IP, Calculations supporting your qualifying profit determination, Any other relevant documentation that supports your IP Box application.

Can I lose my IP Box status once approved?

Yes, you can lose the benefits if you no longer meet the requirements, such as if you stop R&D activities in Cyprus or fail to maintain proper documentation. Regular reviews by tax authorities may be conducted to ensure ongoing compliance. However, past benefits won't be affected if you previously qualified.