Special Defence Contribution (SDC): A Complete Guide

Our blogs are regularly updated to ensure information is current and accurate.

Andreas is a Corporate Lawyer and Managing Director of EasyCorporate. Read more

What Is the Special Defence Contribution (SDC)?

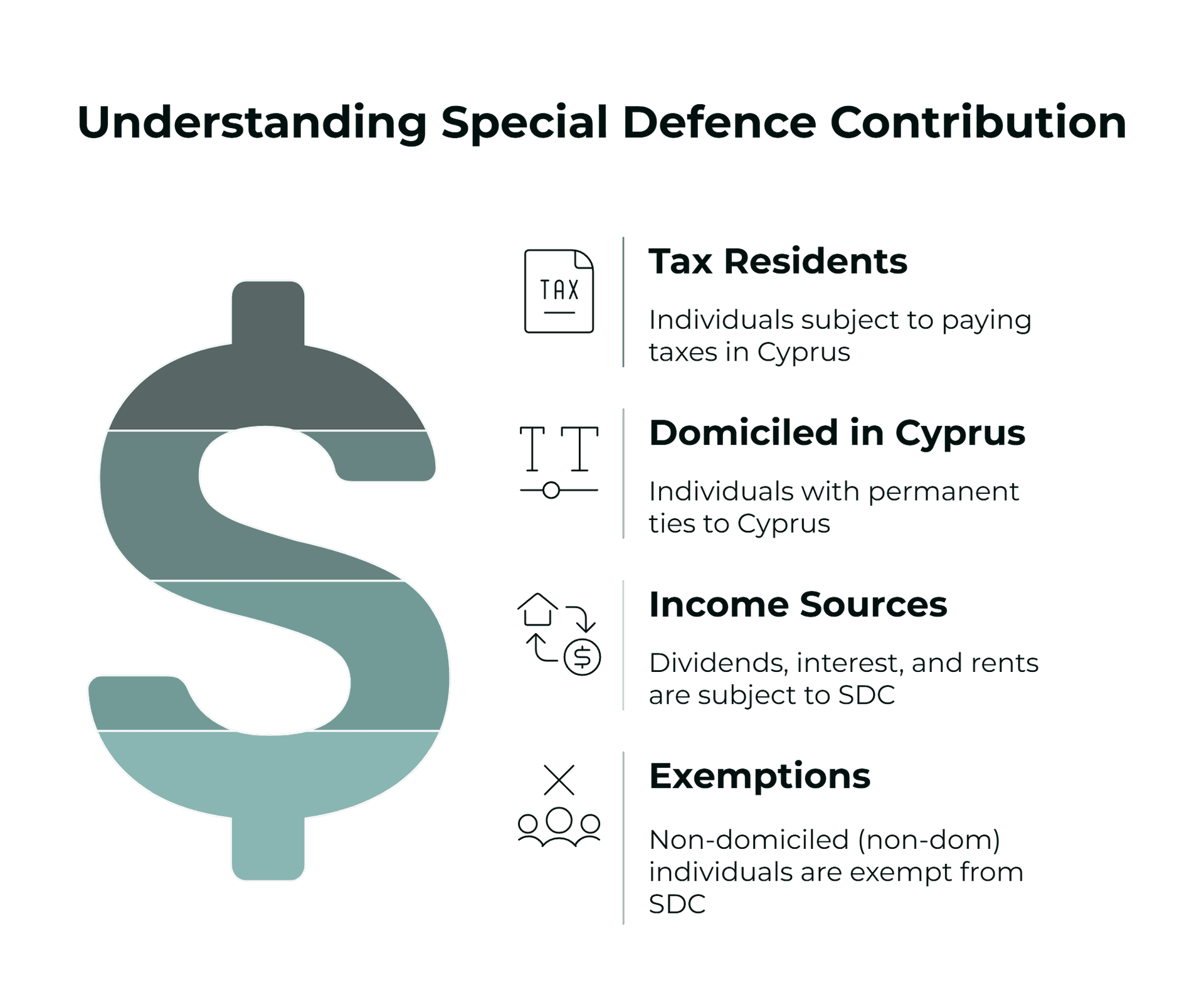

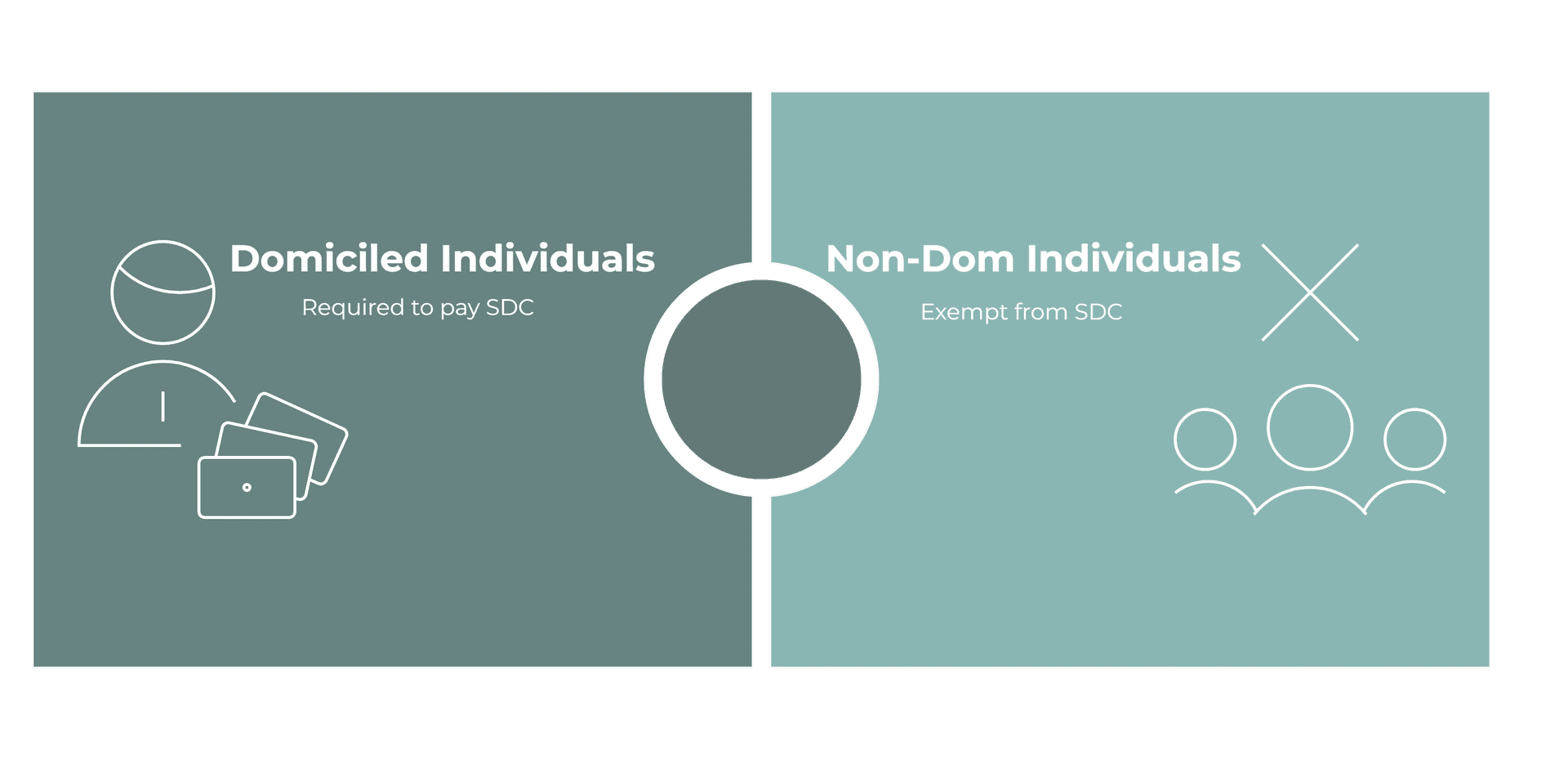

Tax residents of Cyprus that are also domiciled in Cyprus that receive income from dividends, interest and rents are required to pay the Special Defence Contribution (SDC). In essence, the SDC is a tax designed to raise money for the national defence of Cyprus.

Who Is Exempt from SDC?

Non-domiciled individuals are exempt from SDC. Make sure to read our detailed guide on non-domicile to check if you qualify for non-dom status, as well as our 3-Step Non-Dom Tax Optimisation Guide .

Taxation on Dividends

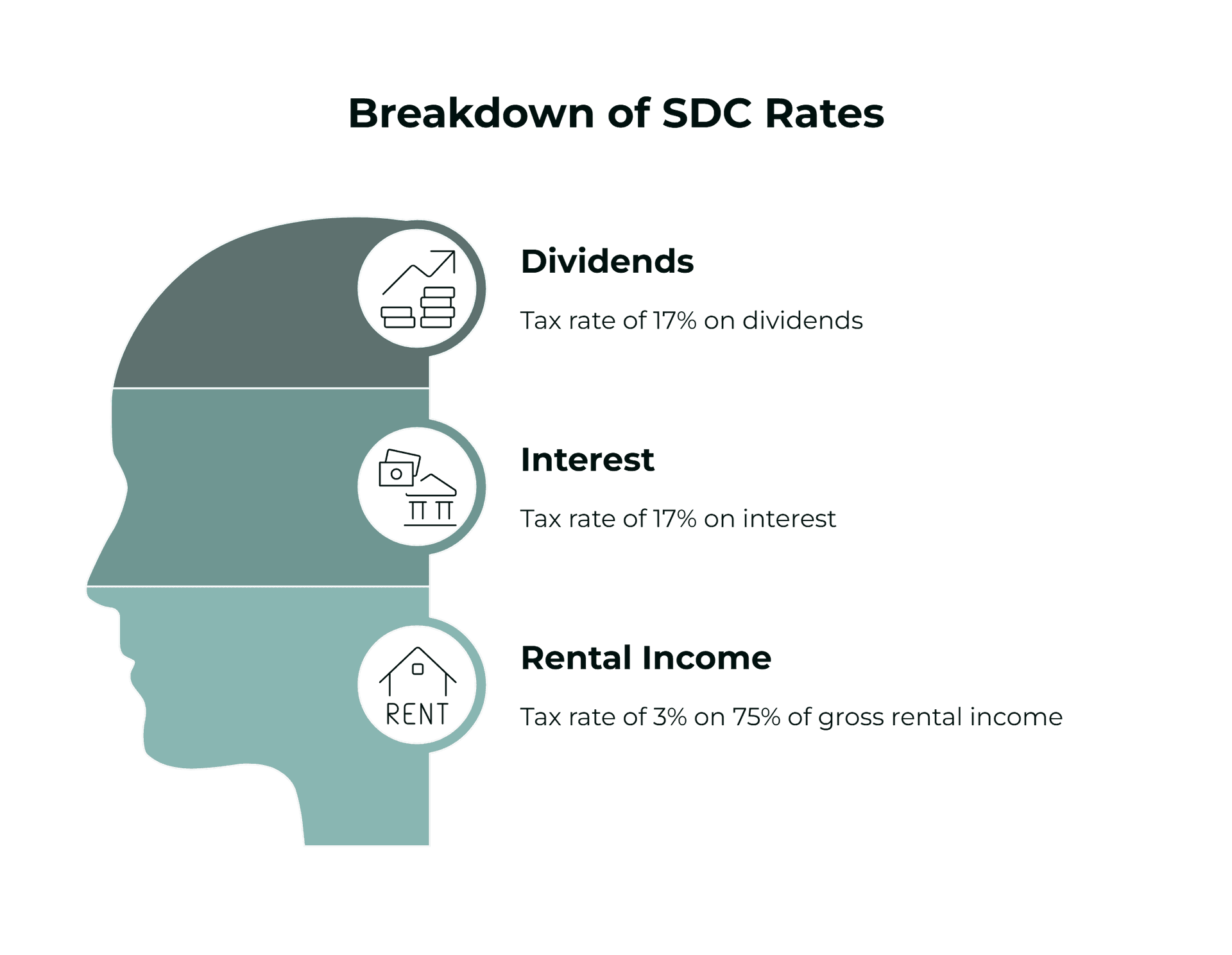

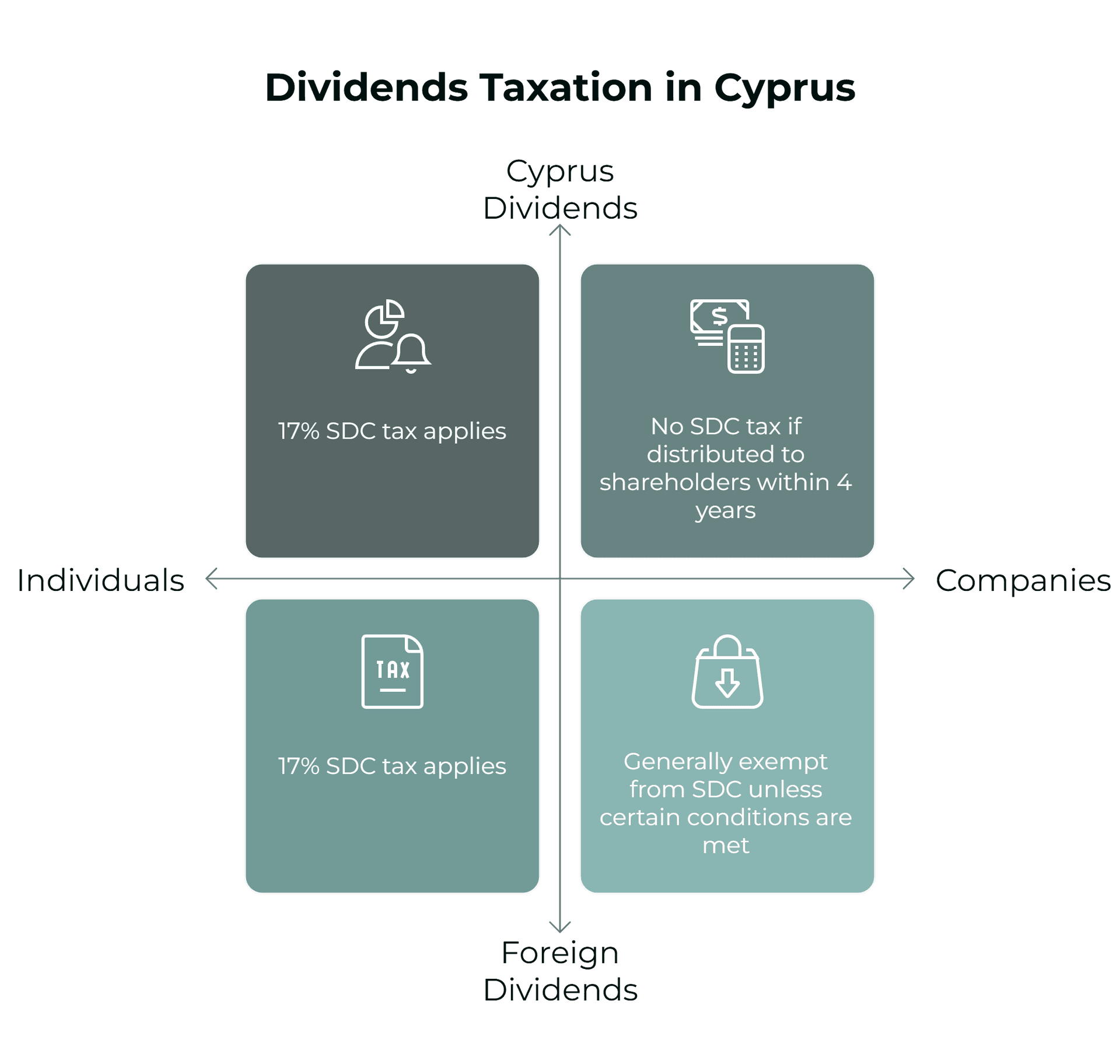

Although dividends are exempt from income tax, they are not tax free. There is a 17% SDC tax on profits distributed by companies to their shareholders. However, different conditions apply depending on whether the shareholder is an individual or a company.

Dividends Received by Individuals

Individuals who are shareholders in a Cyprus company must pay the 17% SDC tax on the dividends they receive. This is also applicable if the dividends received are coming from abroad.

Dividends Received by Companies

If a company in Cyprus receives dividends from another company in Cyprus, it doesn't have to pay the 17% SDC tax on these dividends. However, this exemption applies only if the dividends are distributed within 4 years from the end of the year the profits were earned. After 4 years, the 17% SDC tax applies.

For example:

Company A is a shareholder of Company B. In 2024, Company B earns profits. If Company B distributes these profits as dividends to Company A from 2025 until 2028, then Company A will not pay any SDC tax.

But if Company B distributes these profits as dividends to Company A after 2028, then Company A will be liable to pay the SDC tax.

This exemption to payment of the SDC on dividends received by companies is also applicable to dividends received by a company abroad. This means that a company in Cyprus that is a shareholder in a foreign company, generally won't be required to pay the SDC on the dividends received.

However, the exemption does not apply if the following conditions are met:

-

The foreign company earns more than 50% of its income from investments (like stocks, bonds, etc.), and

-

The foreign company pays significantly less tax on its income compared to what the Cypriot company would pay in Cyprus.

Disposal of Assets

Keep in mind that if a company gives a company asset (like a property) to a shareholder or their close family for free or at below market price, it's still considered as a dividend and is subject to the SDC.

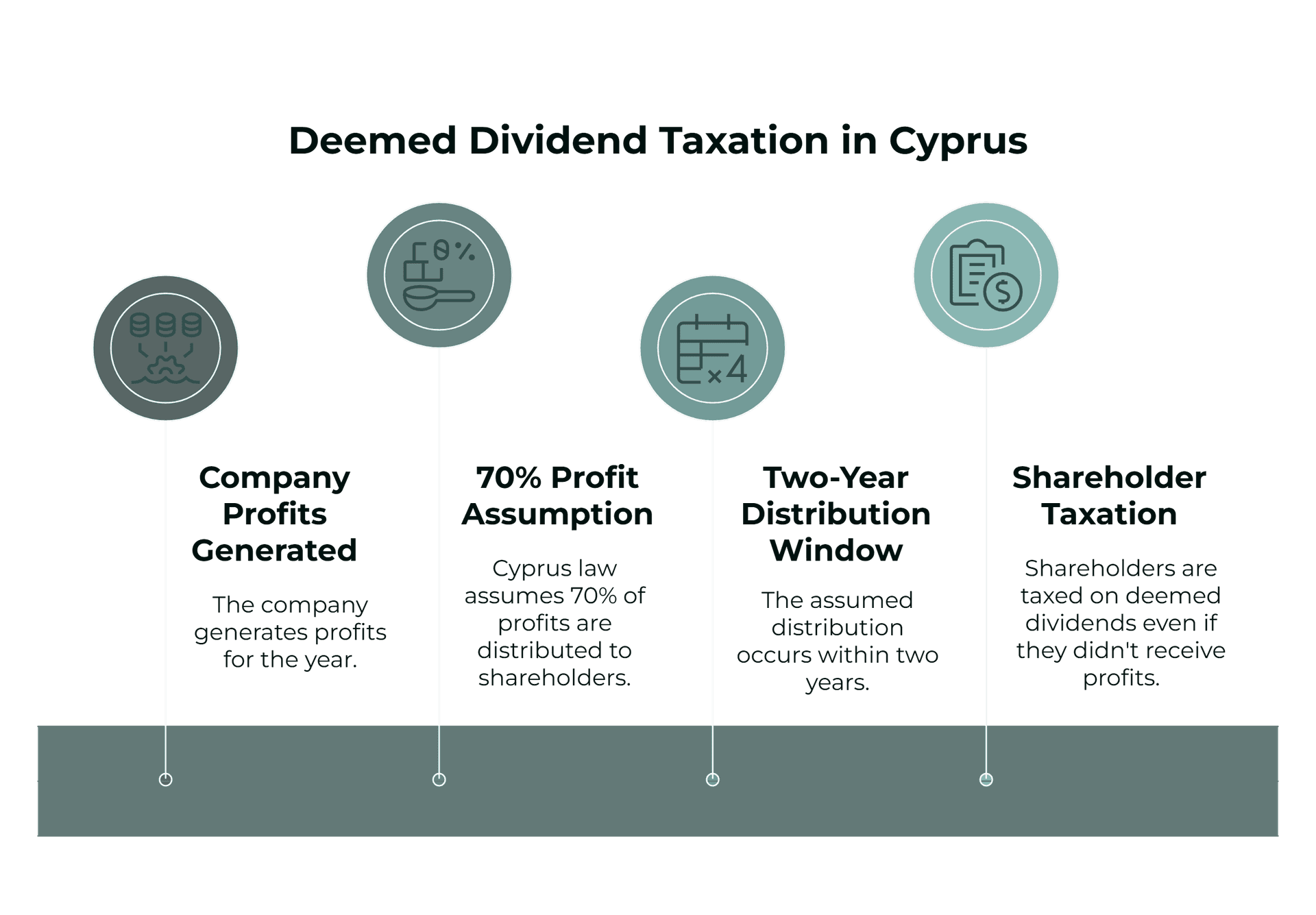

Deemed Dividend Distribution Explained

An important aspect of the SDC to have in mind is that when a company in Cyprus makes a profit, it is assumed that it has distributed 70% of the profits as dividends to its shareholders within two years from the tax year which the profits arise from, which means that the shareholders of the company will be taxed on those “deemed dividends” even if they haven't actually received any money.

The company is then responsible to pay the SDC on those “deemed dividends” on behalf of the shareholders and can then charge it on the shareholders.

For example:

Let's say you are the sole shareholder of a company in Cyprus that made a profit of €10,000 in 2022.

Assuming that the company hasn't paid any dividends to you for that year until 2024, it will be deemed by the Cypriot tax authorities that the company has paid you €7,000 in dividends for the profits of 2022.

The company will then have to pay €1,190 (7,000 x 17%) towards the SDC on your behalf.

SDC Payment Deadlines

Dividends

Companies that pay dividends to their individual shareholders are required to withhold the SDC from the dividends of their shareholders and pay it to the Tax Authorities. Companies must declare these using form TD603 and pay the SDC through the Tax Portal by the end of the month following the month in which the dividends were paid.

For example:

If the company paid dividends to its shareholders in July, they must make the relevant SDC payment by the end of August.

Deemed Dividends

Companies are required to submit the Declaration of Deemed Dividend Distribution (TD623) by the 31st January of the third year after the tax year the profits relate to.

For example:

For example, SDC for deemed dividends from 2022 must be made by the 31st of January 2025.

Alongside paying SDC on deemed dividends, companies must also pay GHS on these deemed dividends on the same date. Payments are made through the Tax Portal.

SDC on Interest: What You Need to Know

Interest is the return on investment when money is saved or invested. If you live in Cyprus and earn interest (with some exceptions), you'll be taxed 17% on that interest.

Business Interest Exemptions

However, interest from everyday business activities is not subject to SDC. What this means is that when a business such as a bank earns or pays interest as part of its everyday activities, that interest is considered normal business interest and the bank is not required to pay the SDC on that interest.

Refund Conditions for Low-Income Individuals

Additionally, if your total annual income (including interest) is €12,000 or less, you can get a refund for any SDC that you paid (or was withheld from your income) over 3%.

Payment of SDC on Interest

SDC on interest must be withheld and paid to the Tax Authorities using form TD602 through the Tax Portal by the end of the month following the month in which the interest was paid.

For example:

For interest payments made in July, the applicable SDC must be paid by the end of August.

SDC on Rental Income

In addition to rental income being subject to income tax, it is also subject to the SDC. Specifically, the law imposes a 3% tax on 75% of the gross rental income.

For example:

Let's say you own an apartment and you rent it for €1000 a month, which comes out to €12,000 a year. You're only subject to paying SDC on 75% of your gross rental income, being €9,000.

Therefore, you'll have to pay (9,000 x 3%) €270 per year towards SDC.

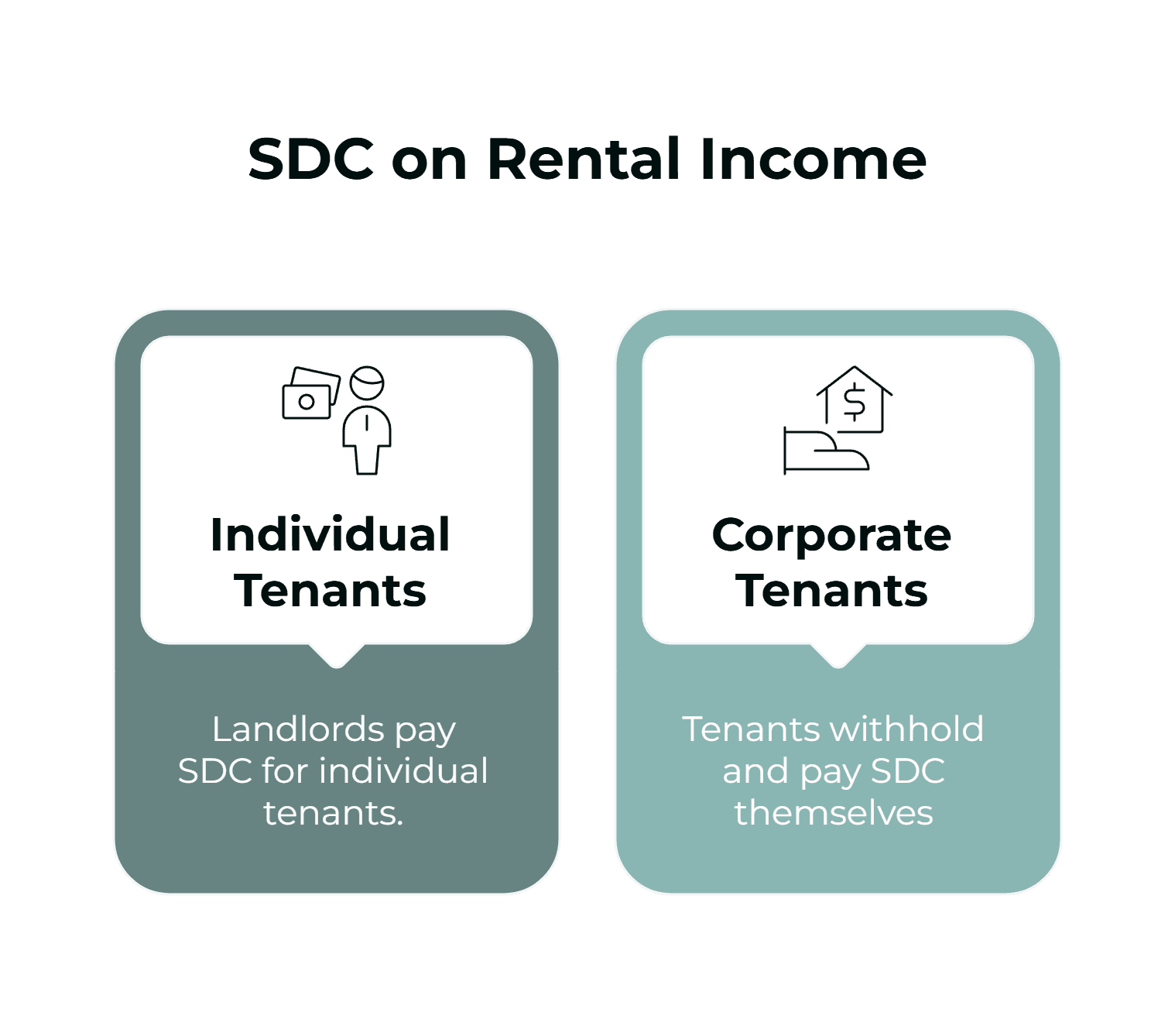

Payment of SDC on Rental Income

Regardless of the amount, rental income is subject to SDC. The method in which payment of the SDC is made is solely dependent on whether the tenant of your property is an individual or a company.

SDC For Individual Tenants

If your tenant is an individual, you must do the following as the landlord:

| Steps | Registration |

|---|---|

| 1 | File a self-assessment on TaxisNet |

| 2 | Payment deadline: 30th of June for the first half of the year, and 31st of December for the second half of the year. |

| 3 | Tax Payments are made through the Tax Portal . |

SDC for Corporate Tenants

If the tenant is a company or partnership, they must withhold SDC at a rate of 3% on 75% of the rent from the gross rental amount. This means that the tenant is responsible for deducting this amount from the gross amount of rent and pay the SDC to the Tax Authorities. To do so, they must:

| Steps | Registration |

|---|---|

| 1 | Submit form I.R.614A and pay the SDC they witheld. |

| 2 | Payment deadline: 30th of June for the first half of the year, and 31st of December for the second half of the year. |

| 3 | Tax Payments are made through the Tax Portal . |

Upcoming Changes to SDC Rules

Some important changes have been proposed by the Cypriot government on the 26th of February 2025. Part of those proposed reforms include changes to the Special Defence Contribution (SDC) regime. Here's what you need to know:

Elimination of Deemed Distribution Rules

The proposal would completely abolish the current rules on deemed distribution of profits, meaning companies would no longer be required to pay SDC on 70% of their undistributed profits after two years.

Abolition of SDC on Rental Income

The existing 3% SDC tax on 75% of gross rental income would be abolished, leaving rental income subject only to income tax.

Reduced SDC Rate on Dividends

For natural persons who are tax residents and domiciled in Cyprus, the SDC rate on dividends would be reduced from 17% to 5%.

For example:

On €10,000 in dividends, you would pay €500 in SDC instead of €1,700, resulting in savings of €1,200.

Just a Heads Up

It's worth mentioning that these changes are just the government's plans for now, based on research done by the University of Cyprus, Ministry of Finance, and tax experts. None of this is set in stone yet.

For any of these changes to actually happen, the House of Representatives still needs to approve the reforms with a majority vote. If that happens, Cypriot docimicled individuals will benefit from a significant reduction in SDC rates on their profits.

How to Manage Your SDC Obligations Efficiently

The Special Defence Contribution (SDC) is a key part of Cyprus' tax system, affecting things like dividends, interest, and rental income. Figuring out when and how to pay SDC can be tricky, whether you're an individual or a business. If you're unsure about your obligations or need help managing your SDC duties, we're here to make it easier for you.

Need Expert Advice on SDC?

Reach out to us today, and we'll take care of the paperwork, ensuring you stay compliant with all SDC rules. Let us handle the details so you can focus on running your business.

Our blogs are regularly updated to ensure information is current and accurate.

FAQ: Common Questions About This Topic

I'm non-dom, do I pay SDC?

No, if you have non-domiciled status in Cyprus, you are completely exempt from SDC payments on all types of income (dividends, interest, and rental income), regardless of where the income is earned. However, you'll still need to pay regular income tax on applicable income types.

I'm moving to Cyprus - do I have to start paying SDC?

You become liable for SDC only when you're both a tax resident and domiciled in Cyprus. Tax residency is typically established after spending 183 days in Cyprus within a tax year. However, being a tax resident doesn't automatically make you domiciled - you'll need to meet additional criteria for domicile status.

What happens if I forget to pay SDC on my rental income?

Late payments of SDC are subject to penalties, including a 5% penalty on the unpaid amount and interest charges. The Tax Department may also impose additional administrative fines. It's recommended to set up calendar reminders for the bi-annual payment deadlines: June 30th and December 31st.

Do I need to pay SDC on interest earned from foreign bank accounts?

Yes, if you're tax resident and domiciled in Cyprus, you must pay 17% SDC on interest earned from both local and foreign bank accounts. However, interest earned from everyday business activities is exempt. You're responsible for declaring foreign-earned interest, as it may not be automatically withheld.

How does the deemed dividend distribution affect my company's cash flow?

The deemed dividend distribution rule requires companies to pay SDC on 70% of profits within two years, regardless of whether actual dividends are distributed. This can impact cash flow planning since you'll need to reserve approximately 11.9% (17% of 70%) of your profits for SDC payment, even if you plan to reinvest the profits.

Can I claim back SDC paid on interest if my income is low?

Yes, if your total annual income (including interest) is €12,000 or less, you can claim a refund for any SDC paid on interest exceeding 3%. You'll need to file a claim with the Tax Department and provide documentation of your total annual income and the SDC withheld.

How is SDC calculated when renting to multiple tenants?

The 3% SDC on rental income applies to 75% of the gross rental income, regardless of the number of tenants. However, the payment process differs: for individual tenants, you'll need to pay directly, while corporate tenants must withhold and remit the SDC. Keep separate records for each tenant type.

What are the implications of the 4-year rule for inter-company dividends?

Companies receiving dividends from other Cyprus companies are exempt from SDC if the distribution occurs within 4 years of earning the profits. After this period, the 17% SDC applies. This encourages timely profit distribution and affects long-term corporate planning and group structure decisions.

How do property transfers to shareholders affect SDC obligations?

hen a company transfers property to shareholders or their close family at below market value, the difference between the market value and transfer price is considered a dividend subject to 17% SDC. This applies even if no cash changes hands, so proper property valuation is essential.